Oil market outlook: Expectations and realities

Oil markets remain impressively stable despite enormous uncertainty around how the Covid-19 pandemic will develop and how fast the global economy (and therefore oil demand) will recover…

Oil markets remain impressively stable despite enormous uncertainty around how the Covid-19 pandemic will develop and how fast the global economy (and therefore oil demand) will recover…

In this TV interview given to Lubna Bouza, Anchor at SkyNews Arabia, Dr Carole Nakhle discusses the impact of the US presidential elections outcome on

In this installment, Dr Carole Nakhle, CEO of Crystol Energy, and Dr Theophilus Acheampong, Senior Consultant at Crystol Energy, analyze whether oil and gas…

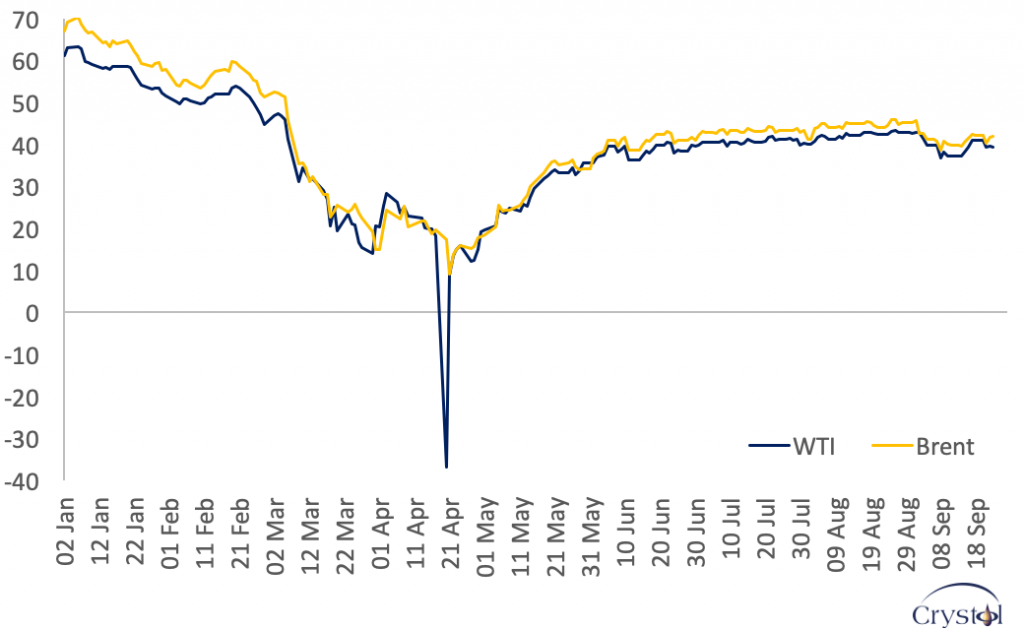

Having stalled through June and July, the recovery of the global oil market seemed to reboot in August. The OPEC+ producer alliance stuck to its schedule and relaxed its cuts by 2 million barrels per day…

Oil markets seem almost frozen, with prices hovering around $40 per barrel (bbl) in June and July after initially recovering rapidly in May.

For most of the oil industry’s earlier history its overarching problem was not shortage but too many producers and too much oil. Could it now be heading back into just that situation?

Dr Carole Nakhle Drastic changes in oil prices, like the one we are witnessing today, typically push many host governments to renegotiate contracts with private

Access for Women in Energy (AccessWIE), in collaboration with IHS Markit, organised an evening seminar on the Future of Oil and Gas Exploration. The event was held at the IHS office in London on 26 February 2020…

Christoff Rühl When Russia walked out on OPEC+ rather than contribute to more output cuts, Saudi Arabia turned on the crude taps. The price collapse