New Opportunities 2021: Some optimism for oil markets

Following the blow dealt to the world by the coronavirus in 2020, one cannot help but hope that 2021 will be better…

Following the blow dealt to the world by the coronavirus in 2020, one cannot help but hope that 2021 will be better…

We are all tired of being told how dreadful the virus-riven 2020 turned out to be, and it certainly ended for Britain fairly uncomfortably, with Christmas virtually abolished, ports jammed, and British air-travellers barred form fifty countries…

Oil markets remain impressively stable despite enormous uncertainty around how the Covid-19 pandemic will develop and how fast the global economy (and therefore oil demand) will recover…

In November, new vaccines showed great promise in fighting Covid-19, and the exhilaration was clear in markets around the world. However, the enthusiasm was not sustained…

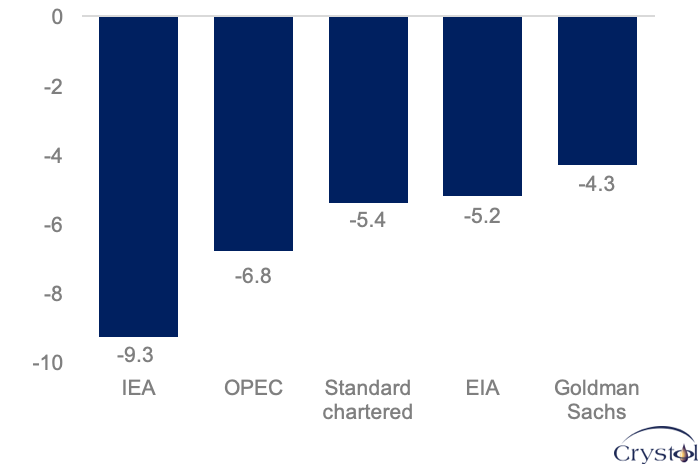

“A crisis like no other.” This is how the International Monetary Fund (IMF) described the COVID-19 crisis, which hit the world economy like a tsunami, imposing unparalleled financial pain

Oil markets remain impressively stable despite enormous uncertainty around how the Covid-19 pandemic will develop and how fast the global economy (and therefore oil demand) will recover…

In this installment, Dr Carole Nakhle, CEO of Crystol Energy, and Dr Theophilus Acheampong, Senior Consultant at Crystol Energy, analyze whether oil and gas…

Having stalled through June and July, the recovery of the global oil market seemed to reboot in August. The OPEC+ producer alliance stuck to its schedule and relaxed its cuts by 2 million barrels per day…

Nigeria has long been battling structural problems, particularly in its economy and oil sector. The Covid-19 pandemic and subsequent economic shocks only magnified them.

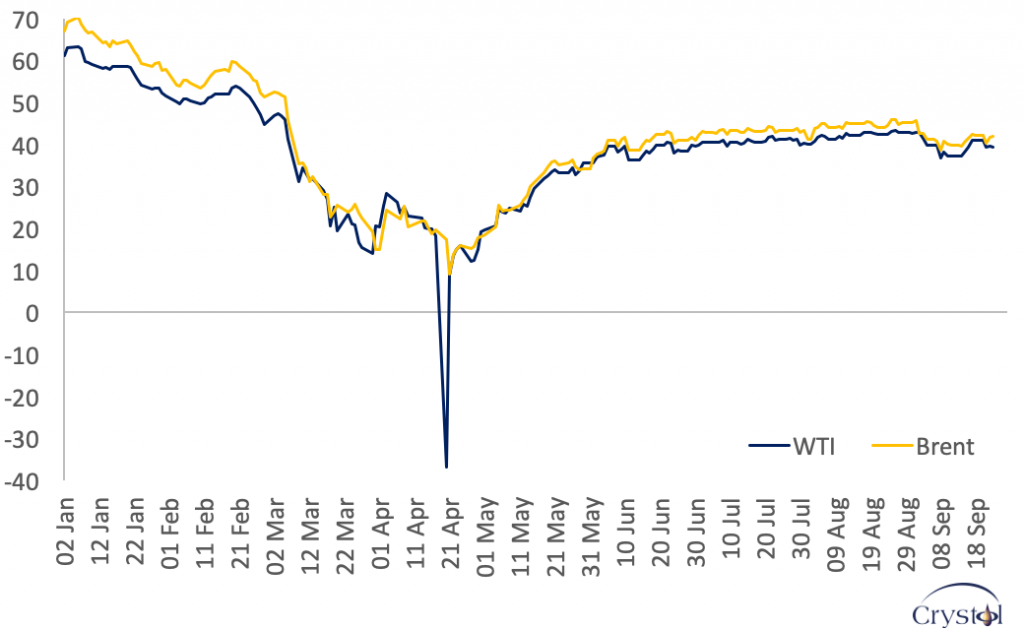

Oil markets seem almost frozen, with prices hovering around $40 per barrel (bbl) in June and July after initially recovering rapidly in May.

Most experts believe the worst is over for oil markets. Prices have gone up from the record lows reached in April.

Nigeria has long been battling structural problems, particularly in its economy and oil sector. The Covid-19 pandemic and subsequent economic shocks only magnified them.

Measures aimed at containing the spread of Covid-19 have caused acute economic pain among major oil-producing countries, as the collapse…

For most of the oil industry’s earlier history its overarching problem was not shortage but too many producers and too much oil. Could it now be heading back into just that situation?

Dr Carole Nakhle Drastic changes in oil prices, like the one we are witnessing today, typically push many host governments to renegotiate contracts with private

Dr Valentina Dedi, Panagiotis Mavroeidis-Kamperis Last December, in alignment with the European Union (EU) legislation, Greece submitted a revised version of its 10-year National Plan

For many years, 2020 will be remembered as the year that brought the world economy on its knees and oil markets with it. The COVID-19

This will be a watershed year in the history of oil markets. Since 2020 began, several unprecedented developments have taken place, from an unparalleled decline